But you must be enrolled in a high deductible health plan to qualify so they arent right for everybody. All of our high deductible insurance plans offered with an hsa meet the irs requirements.

Health Savings Account Hsa Plans Unitedhealthcare

Health Savings Account Hsa Plans Unitedhealthcare

What Is A Health Savings Account And Should I Open One

What Is A Health Savings Account And Should I Open One

About the health care savings plan.

Health care savings plan. It was true of virtually all health savings account plans offered by large employers and over 95 of the plans offered by small employers. You not your employer or insurance company own and control the money in your hsa. By using untaxed dollars in a health savings account hsa to pay for deductibles copayments coinsurance and some other expenses you may be able to lower your overall health care.

To get the benefits of an hsa the law requires that the savings account be combined with a qualified high deductible health insurance plan which can cost less than other health insurance plans. Health savings accounts hsas are like personal savings accounts but the money in them is used to pay for health care expenses. In 2016 the minimum annual deductible of a qualified hsa plan for an individual is 1300 and 2600 for a family.

Health savings accounts hsa are individual accounts offered by optum bank member fdic and are subject to eligibility and restrictions including but not limited to. A type of savings account that lets you set aside money on a pre tax basis to pay for qualified medical expenses. A recent industry survey found that in july 2007 over 80 of health savings account plans provided first dollar coverage for preventive care.

Payments are made directly to your financial institution. Direct deposit direct deposit is the safest fastest and most convenient way to receive your payment. These include medical dental and vision expenses including premiums for you your spouse children up to the age of 26 and any.

1 qualified medical expenses may not be covered under your plan. Health savings accounts let you pay out of pocket healthcare costs with pre tax dollars. Welcome to the health care savings plan hcsp administered by minnesota state retirement system msrs.

Health care savings plans allow you to invest tax free money in a health care savings account while you are employed with hennepin county that you can use for qualifying medical expenses after you leave the county. The hcsp is an employer sponsored program authorized by minnesota state statute 35298employees invest in a tax free medical savings account while employed by a minnesota public employer including city state county school districts and governmental. 2 adjusted annually in accordance with the consumer price index.

Why high deductible health insurance. Health care savings plan find insurance quotes right now online for your car home life health travel and more. We will help you to save money and time.

Tax Statements Mailed By January 31 Hcsp Msrs

The Bahnsen Group The Financierge

The Bahnsen Group The Financierge

Health Care Union To Introduce Low Fee Portable Savings Plan

Health Care Union To Introduce Low Fee Portable Savings Plan

Minnesota State Retirement System Health Care Savings Plan Plan

Minnesota State Retirement System Health Care Savings Plan Plan

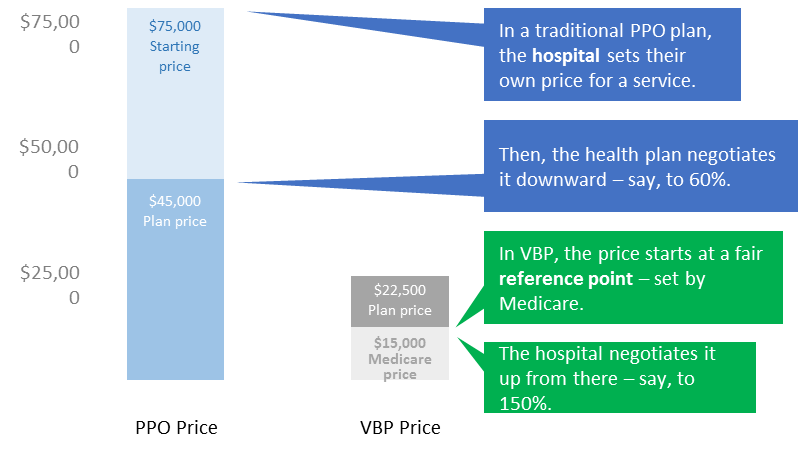

Maximize Healthcare Savings With Value Based Payments Onedigital

Maximize Healthcare Savings With Value Based Payments Onedigital